Master in Financial Management

- ONLINE

- 60 ECTS

- 7700€

- OPEN CALL

- 12 MONTHS

- SPANISH

The Master in Financial Management, with a Master's degree in lifelong learning, the programme aims to strengthen the different management skills and provide comprehensive training in finance. It explores topics related to the financial evaluation of investments, as well as offering tools for the definition and implementation of business strategies from an international perspective.

This Master's Degree is recognised with the 5th position in the Finance category of the El Mundo Ranking, and is also in the TOP 6 in Spanish in the Finance category of the Best Masters Worldwide Ranking of Eduniversal.

Master in Financial Management (Spanish)

Universitat de Barcelona

Get a double degree from our academic partner, the reference university in Catalonia and Spain with more than 560 years of history behind it.

Ranking El Mundo

The programme has been recognised with the 5th position in the Finance category of the Ranking of the Best Online Masters in Spain according to the leading newspaper El Mundo.

Ranking Eduniversal

The Master in Financial Management has obtained the 6th position in Spanish in the Financial Markets category in Eduniversal's Best Masters Ranking.

Master's Degree in Financial Management Syllabus

Our programme is structured in 4 main blocks and culminates with the Master's Final Project. In addition, during the course of the programme you will be able to take part in three voluntary bootcamps and other additional activities.

Block 1. The financial department in the company's environment

Block 2. Financing decisions

Block 3. Investment decisions

Block 4. Management decisions

Master's Final Project

Bootcamps and additional activities

1. The financial department in the company's environment

Within the different areas of the company and under the supervision and direction of the Chief Executive Officer, the Finance Department is probably the one with the most transversal nature and whose decisions have the most relevant impact on the whole organisation. This is why this module details the main characteristics of a financial department, as well as the different types of business organisation.

Professor: Jesús Javier Reglero Sánchez, Partner at RS Corporate Finance.

VIEW LINKEDIN

2. Financing decisions

Depending on the type of company, the sector of activity and its geographical location, the sources of financing may be more or less diverse and the objective of the financial manager will be to find the best of them. For this reason, this module analyses all the alternatives and options that companies have for financing their activities.

Professor: Rafael Hurtado Coll, Chief Investment Officer (CIO) and Chief Strategy Officer (CSO) at Allianz.

VIEW LINKEDIN

An important defining characteristic of today's business environment at the beginning of the 21st century is the need for internationalisation or globalisation. Every company must be able to develop its potential not only in its domestic market but also in the framework of an international global economy. Throughout this course, students will learn about topics such as the foreign exchange market, foreign trade, risk management and international taxation, among others.

Professor: Alberto Reglero Sánchez, Senior Manager KPMG Forensic (Dispute Advisory Services).

VIEW LINKEDIN

3. Investment decisions

Once the economic resources, obtained from the different sources of finance, are in the company, it has to invest them with the objective of creating value for the stakeholders. To this end, this module covers all areas of the financial department, since it is related to the use of funds raised by the company from fund providers, and deals with subjects such as the time value of money, investment valuation methodologies (NPV, IRR and Payback), investment typologies and stock market analysis (technical and fundamental), among others.

Professor: Martí Pachamé Barrera, Economic Advisor, Santa Coloma de Gramenet City Council, Barcelona.

VIEW LINKEDIN

This subject has a transversal character being related to different modules, such as Mergers and Acquisitions, Sources of Financing or Investment Selection. In it, the main tools and methodologies related to finance are learnt. The main topics covered include value management and measurement, value creation, company valuation methodologies and financial reporting, among others.

Professor: Juan Fuertes Fernández Labastida, Administrative-Accounting Manager at Economía Digital Diario Online.

VIEW LINKEDIN

Cross-border mergers are frequent in an increasingly complex and globalised world. Thus, this module will analyse, from an international context, the area of corporate operations, as well as the reasons why companies carry out these corporate movements. Specifically, topics such as the types of corporate operations, as well as their advantages and disadvantages, the financial analysis of a corporate operation and the processes of buying and selling companies, mergers and restructurings, among others, will be covered.

Professor: Jesús Javier Reglero Sánchez, Partner at RS Corporate Finance.

VIEW LINKEDIN

4. Management decisions

The complexity of day-to-day business has combined with the speed and constant change that business actors have to undergo and deal with. This, combined with globalisation and the financial and economic crisis of recent years, has led to increased uncertainty in decision-making. Risk has increased in general and has become one of the strategic aspects considered in organisations. Thus, in this module we will study techniques to manage and limit these risks.

Professor: Pere Joaquín Brachfield Montaña, practising lawyer, member of the Barcelona Bar Association (ICAB).

VIEW LINKEDIN

Information is fundamental to decision-making. The importance of financial decisions reinforces the need to have reliable, flexible and efficient information systems in order to have access to it. The course will analyse aspects such as: (I) generating added value from the information available, (II) converting information into knowledge, (III) implementing an information system within a financial department.

Professor: Salvi Hernández Barjola, CEO at Sigma Consulting Asociados.

VIEW LINKEDIN

Managing cash flow or cash management involves determining what the operational needs for funds are over time. Thus, this module deals with the management of the company's current assets, i.e. cash, customers, stocks and suppliers, as well as the key aspects of negotiating with financial institutions to obtain these resources, if necessary.

Professor: Rodrigo Yagüe Juárez, RS Corporate Finance Director.

VIEW LINKEDIN

This subject focuses on a large part of the control activities that are carried out in the financial department, such as business forecasts, analysis of financial statements or cost accounting.

Professor: Jerónima Revelo Parro, Financial Analyst and Head of Consolidation at Kao Corporation.

VIEW LINKEDIN

Bootcamps and Additional Activities

This programme is designed to complement the content of the thematic blocks with the necessary training to achieve their internalisation. The training is conceived from a threefold perspective: technical assistance, personal support and individual and group challenges that are necessary to achieve the objectives set.

Pre-Masters Bootcamps

The student will have the opportunity to take 3 Pre-Master Bootcamps that will be opened progressively and can be taken at any time. Once the course has been completed and passed, a certificate of completion will be awarded.

- Bootcamp 1. Personal Branding

- Bootcamp 2. Data Storytelling

- Bootcamp 3. Creative thinking and innovation

In addition, students will also have the opportunity to take these pre-master courses; however, these are available in English only:

- Building Your Professional Brand for Employability and Career Success

- Finance Fundamentals

Introductory workshop | Campus Training

Before the start of the academic year, students will have the opportunity to attend an introductory workshop on the Campus where they will be provided with the tools and knowledge necessary for the correct use of the platform during the academic year.

Professional Development Programme (PDP)

Two weeks before the start of the academic year, students will be able to participate in a professional development programme where they will work hand in hand with a teacher to develop different skills such as time management, productivity and stress management and emotional intelligence. Upon completion of the workshop, and provided that the relevant activities have been carried out, a certificate of completion can be obtained.

The Master's Final Project will consist of a team project on a cross-cutting theme related to the programme. This project allows students to select the subject they like the most and design the content of the project based on that area. The project has been designed so that the team can study in depth some of the areas of greatest interest from a theoretical-practical point of view.

Professor: Jesús Javier Reglero Sánchez, Partner at RS Corporate Finance.

VIEW LINKEDIN

The Master's in Financial Management is complemented by lectures, workshops and seminars that are given in each of the blocks. These additional activities are carried out by renowned professionals in business management who, through videoconferences, present their experiences and case studies.

Bootcamp: Investment Banking

The purpose of the bootcamp is to provide an in-depth understanding of the activities and the different areas of action of investment banks in terms of financing, investment and their participation in the financial markets. This bootcamp lasts four weeks.

Professor: Jesús Javier Reglero Sánchez, Partner at RS Corporate Finance.

VIEW LINKEDIN

Bootcamp: Portfolio Management

The purpose of the bootcamp is to provide the necessary knowledge to understand and analyse the main elements and variables used in Portfolio Management. This bootcamp has a duration of four weeks.

Professor: Rodrigo Yagüe Juarez, Associate at RS Corporate Finance.

VIEW LINKEDIN

Bootcamp: Financial System

This bootcamp will cover topics such as the financial system in the context of the economy, monetary policy and the banking system and the functioning of financial institutions. This bootcamp lasts four weeks.

Professor: Jaime Martínez Tascón, Partner of Inveretik and High Net Worth Agent at Bankinter.

VIEW LINKEDIN

Company visits

During the programme, students will have the opportunity to attend synchronous videoconferences with professional experts in the programme area. They will share their experience and provide best practices in the sector.

Webinars

Most of the training is done asynchronously, that is, the exchange of knowledge is done through a platform that allows sharing written texts without the need for people to be connected at the same time. Additionally, in each of the modules, synchronous sessions or 'webinars' are organised, where all participants are connected at the same time through an application, which allows the exchange of knowledge in 'real time'.

Students taking the Master in Financial Management will have the opportunity to prepare for the Scrum Certification (Product Owner & Scrum Master)*.

*The cost of the certification is not included in the price of the programme.

Methodology

OBS has an online methodology where the core is the student. Always backed by active and internationally renowned lecturers, who share their knowledge to enhance the professional development of students through a flexible, collaborative method with personalised monitoring. The aim is to create a unique educational experience that allows the assimilation of knowledge in a practical way.

Student ON's fundamental pillar is the student and, for this reason, throughout the course students have their Programme Manager, an academic figure who accompanies them in a personalised way.

Diploma

After successfully finishing the Master's degree, and having completed the relevant procedures, you will receive the Master's degree from OBS Business School. In addition, and provided that you meet the established academic and administrative requirements, you will obtain a Lifelong learning Master's degree from the Universitat de Barcelona (UB).

In order to obtain it, you must have a university degree. In the exceptional case of not having this degree and having passed the Master's evaluations, you will obtain a Higher University Diploma from the Universitat de Barcelona (UB).

At OBS Business School we are committed to having our own degree, which allows us to quickly update and adapt the programmes in each edition to be at the forefront of the educational level demanded by companies today. Our programmes are designed for professionals who want to strenghten their management skills and learn through an international experience.

Admission Process

The fundamental aim of our admissions process is to ensure the suitability of candidates. All participants should get the most out of this learning experience, through a context in which it is possible to develop long-term relationships with classmates, faculty and alumni.

After completing the application form for one of our programmes, you will receive an e-mail with information about the School and a member of the Admissions Department will contact you to start the admission process.

Once you have successfully passed the personal interview, you must submit all the required documentation to continue the admission process and certify that you meet the requirements of the student profile. After the Admissions Committee, if it is positive, you will be able to register and enrol in the programme you have applied for.

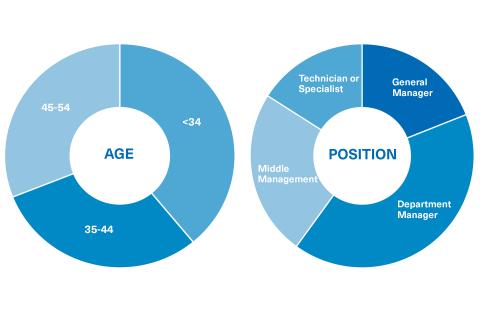

Student Profile

Our Master in Financial Management students have a common goal: to enhance their knowledge in investment, finance and sustainable business growth.

Career opportunities on the Master's Degree in Financial Management

Thanks to the Master's Degree in Financial Management you will be able to develop your professional career as:

- Financial Director

- General Manager

- Financial Department Manager

- Financial planning manager

- Financial manager

- Investment manager in companies and investment agencies

- Treasury manager

- Private banking professional

- Mergers and acquisitions consultant

- Financial controller

- Financial consultant

- Risk analyst

- Financial advisor in private banking and venture capital